Administration Explores Bitcoin Acquisition Without Tax Hike

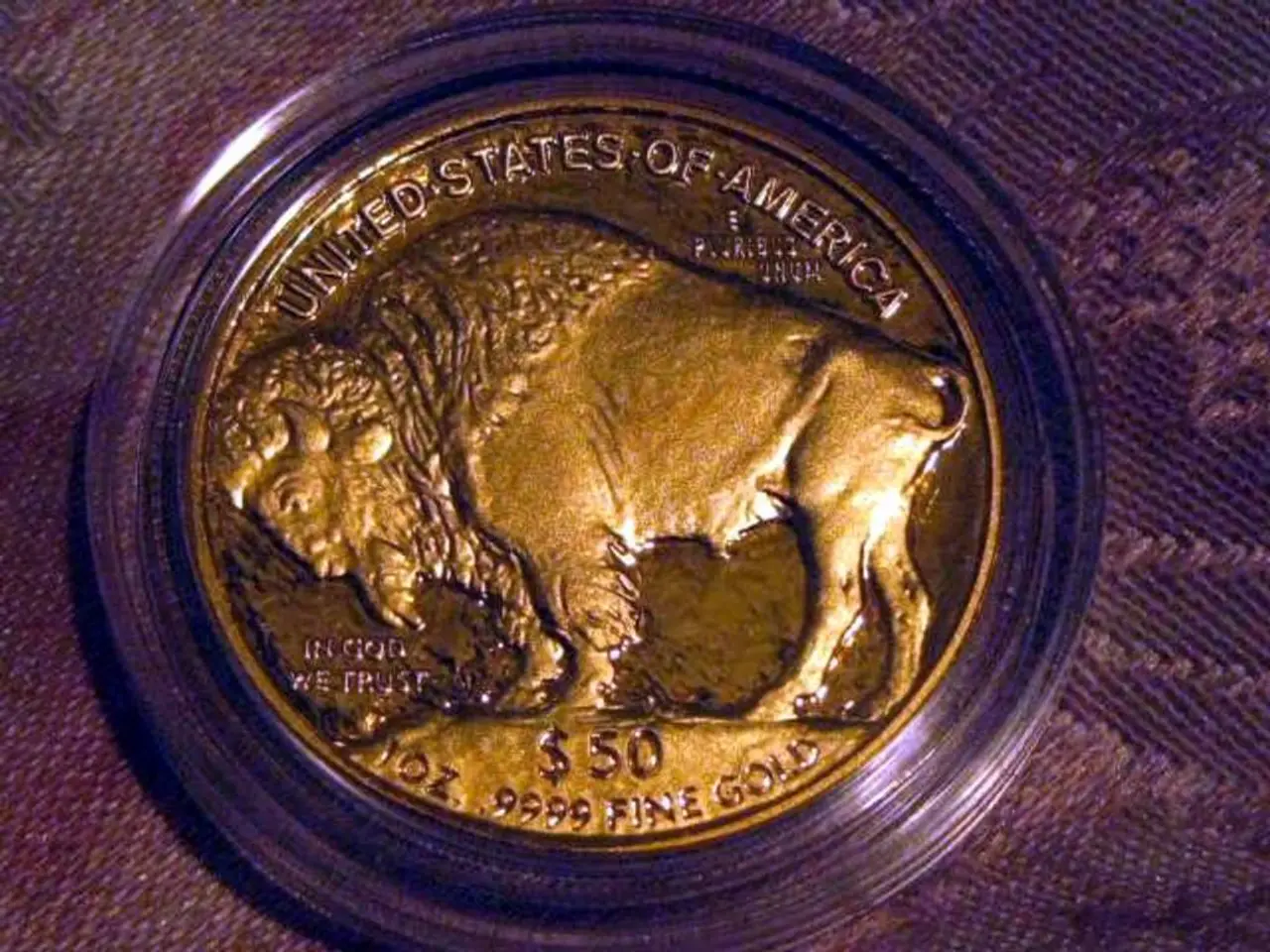

The administration is exploring innovative ways to acquire Bitcoin, with a focus on obtaining as much as possible without increasing the burden on taxpayers. One method under consideration is revaluing gold certificates to fund Bitcoin purchases.

The administration is open to various strategies for Bitcoin acquisition. A White House economic projection suggests that a global tariff of 10% could grow the economy by $728 billion, and the administration is exploring budget-neutral ways to use this revenue to buy Bitcoin. Additionally, the administration is considering Senator Cynthia Lummis' proposed BITCOIN Act of 2025, which aims to have the U.S. acquire 200,000 BTC annually for five years.

It's worth noting that while the administration is open to these methods, there is no official proposal from the White House or relevant experts suggesting the revaluation of gold certificates to buy Bitcoin. This idea has been discussed in financial policy debates but has not been officially presented as a means to acquire Bitcoin.

The administration is actively seeking ways to accumulate Bitcoin without increasing the financial burden on taxpayers. While methods such as using tariff revenue and considering Senator Lummis' proposal are being explored, the idea of revaluing gold certificates to fund Bitcoin purchases remains unconfirmed and should be viewed with caution.

Read also:

- Regensburg Customs Crackdown Nets 40+ Violations in Hotel Industry

- Mural at blast site in CDMX commemorates Alicia Matías, sacrificing life for granddaughter's safety

- Germany Boosts EV Charging: 1,000 Fast-Charging Points on Motorways by 2026

- Albanese Invites LuLu Group to Australia as Free Trade Deal Takes Effect