Gold and Bitcoin Surge Amid Dollar Weakness and Fed Rate Cuts

The US dollar's weakness and anticipated interest rate cuts by the Federal Reserve are driving up stocks, gold, and Bitcoin simultaneously. Both gold and Bitcoin, considered hard currencies, are maintaining their value even in inflationary times, with Bitcoin achieving digital scarcity.

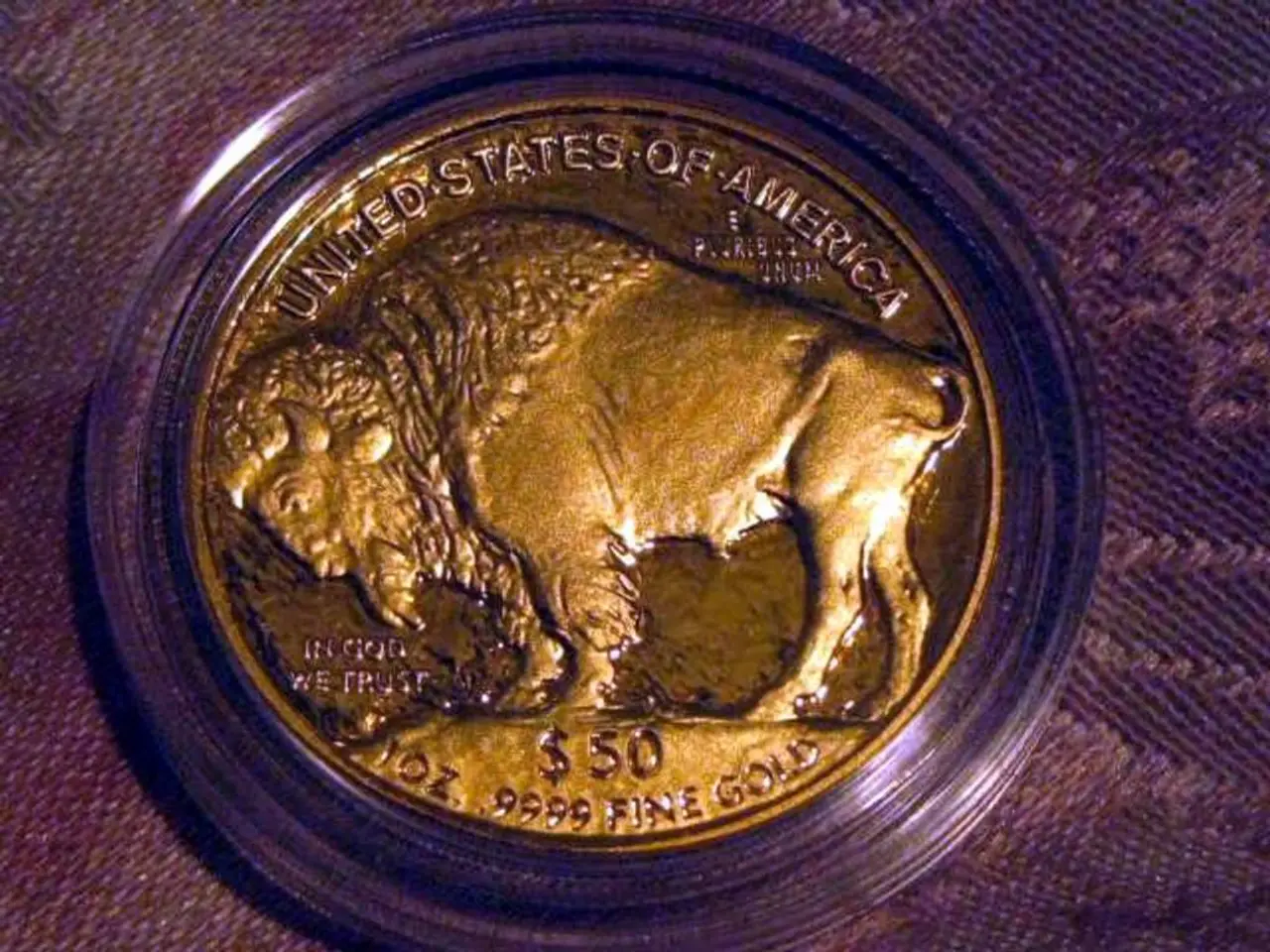

Gold and Bitcoin have both experienced bear markets. Gold took 27 years to reach its next record high after the 1980s crash. Bitcoin, on the other hand, experiences a deep bear market every four years. Currently, they are in a fierce race, with Bitcoin reaching a record high of $125,000 and gold approaching $4,000. Gold's price increase has been stronger, with almost 50 percent in dollars, breaking out from its long-term fluctuation around the $2,000 mark. Bitcoin's price has risen by around 30 percent in dollars and 17 percent in euros since the beginning of the year.

According to the gold-beer ratio, at this year's Munich Oktoberfest, one could get 186 liters of beer for an ounce of gold, the third-highest value since records began. Approximately 210,000 tons of gold have been mined to date, with an annual addition of 3,000 to 4,000 tons, but the supply cannot be infinitely expanded. Similarly, there will never be more than 21 million Bitcoins, with 19.92 million already 'mined', and the last one expected to be fully available around the year 2140.

Billionaire hedge fund manager Paul Tudor Jones, currently commenting on the market dynamics of gold and Bitcoin, predicts a massive rally in both, along with tech stocks. However, he warns about the explosive and risky nature of this rally, urging quick exits when momentum shifts. This year's Bitcoin rally has been quite modest compared to previous bull runs, possibly due to increased acceptance in the financial world.

Read also:

- Mural at blast site in CDMX commemorates Alicia Matías, sacrificing life for granddaughter's safety

- Increased energy demand counters Trump's pro-fossil fuel strategies, according to APG's infrastructure team.

- Space Solar Power Could Cut Europe's 2050 Energy Costs by 7-15%

- Goodyear Forges Ahead in 2025 with Kmax Gen-3 for Enhanced Total Mobility through Nufam Project